FTX Crypto Platform Downfall : A Look At Critical Aspects

Cryptocurrency Exchange Platform FTX’s $32B drastic downfall

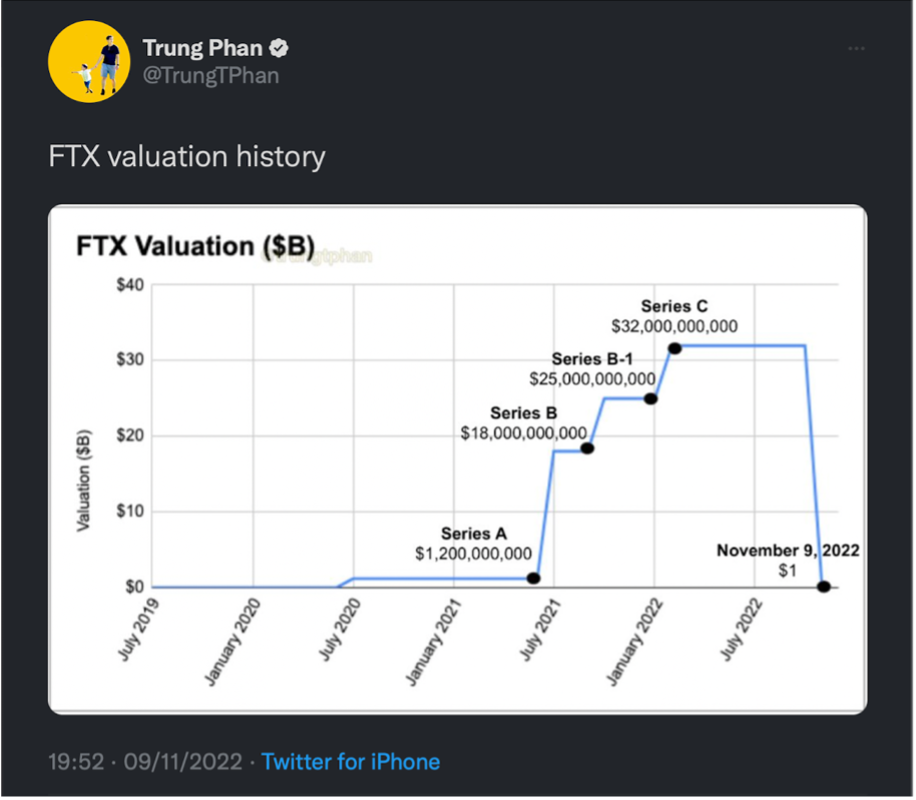

Today, we’re narrating what critical aspects caused the drastic downfall and subsequent bankruptcy of crypto FTX. Two weeks ago the Bahamas-based cryptocurrency exchange saw its value collapsed from $32 billion to zero in a single day.

Sam Bankman-Fried, the company’s creator (who goes by SBF), saw his net worth fall from $16 billion to nothing . The entire drama played out on Twitter and this blog post serves you to have a better understanding of what’s going on!

From Valuation to Peak

What’s really criminal?

The theft of almost $10 billion in customer deposits is the criminal aspect in the case of FTX (as a teaser of what’s to come, SBF informed Reuters that mis-handled monies were caused by “confusing internal labelling”).

The sad saga is still ongoing but here are key points:

- The now 30-year-old SBF is an MIT grad who worked at a quant trading firm (Jane Street) before founding a crypto hedge fund/market maker (Alameda Research) and a crypto exchange (FTX) in 2019

- The relationship between Alameda Research and FTX has always been opaque (eg. some people believe that Alameda front runs trades based on the information it has from the FTX exchange; SBF has denied this but…well, you’ll see)

- One of the earliest investors in FTX was Binance, the world’s largest crypto exchange that is run by Changpeng Zhao (everyone calls him CZ). In 2019, CZ invested $100m into FTX for 20% of the firm.

- FTX has an underlying token called FTT, which offers certain benefits for users of the FTX crypto exchange but — in reality — has no underlying value outside of what people believe it is worth (like most crypto tokens)

- Over the past year, SBF’s profile has risen significantly as FTX raised >$2B from platinum investors and gained a valuation of $32B. SBF’s personal wealth swelled to $16B and he talked up his commitment to effective altruism (he only wanted to make money to “give it away”). SBF also became one of the Democratic party’s biggest donors.

- FTX deployed $300m+ on marketing to woo retail investors including stadium naming rights (Miami Heat, which has since dropped FTX), sports partnerships (Steph Curry, Tom Brady) and Super Bowl ads (Larry David). The PR push worked with FTX becoming the 2nd or 3rd largest crypto exchange in the world (FTX also has a US-based firm called FTX US — once valued at ~$8B — which was ostensibly not involved in the financial shenanigans but…well, you’ll see).

- CZ sells out of FTX. By the Fall of 2021, FTX had become a serious competitor to Binance and CZ wanted to sell his FTX stake. SBF bought CZ out for $2B+, but part of the deal included CZ receiving a lot of FTT tokens (remember this fact).

What lead FTX to be cornered?

In March 2022, the Fed started raising rates to battle inflation.

Speculative assets, like cryptocurrency, started to decline. Several cryptocurrency funds and brokerages went bankrupt.

SBF entered the picture as a bailout “saviour” (crypto lender BlockFi was reportedly saved in order to draw depositor money into FTX’s scheme). As we now know, the crypto collapse had a significant impact on SBF’s hedge fund Alameda Research as well. SBF, however, was able to cover up the issue for a while by “borrowing” (*cough* steal *cough*) customer deposits at FTX (between $5B and $10B) to close the gap at Alameda. The offence is this action, which contravenes the conditions of service.

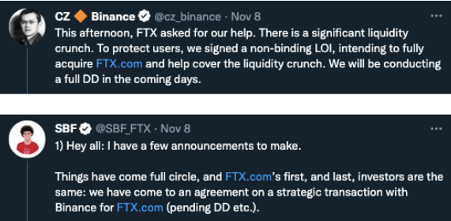

Binance step back

After Binance and FTX started talking to buy the company, suddenly Binance stepped back… Look at this tweet!

The “revelations” that surfaced were probably a Coindesk post stating that Alameda Research’s own FTT tokens made up almost half of its assets ($6 billion out of about $15 billion).

Now, remember how we said the relationship between FTX and Alameda Research was opaque?

Well, Jon Wu explains how the game may have been played:

- FTX creates FTT token

- Alameda buys FTT at a super-low price

- FTX pumps FTT

- Alameda posts FTT back to FTX as collateral, borrowing “real” assets from FTX’s customer deposits

The “value” of FTT relies entirely on the public’s perception of SBF and FTX (and the sky-high reputation was due to fawning press, famous partnerships and a seemingly strong business).

By early October, there were visible cracks in the flawless façade (as described in a Twitter thread):

- Trading volume had decreased due to the cryptocurrency crash;

- Decentralised exchange competition was growing;

- Top executives were quitting their jobs;

- SBF was engaging in sporadic side projects (even attempting to enter Elon’s deal for Twitter);

- The market manipulation allegations persisted.

Back to CZ, You know who he is?

He is the richest individual in the sector and runs the biggest cryptocurrency exchange in the world. CZ is the type of person that may shatter trust in a crypto asset. When he sold his FTT investment ($500m+), that is exactly what happened. He may have done it after seeing Alameda’s balance sheet….

In any case, after CZ ditched the FTT, SBF attempted to calm the market. Among his assertions: “FTX is fine, the assets are good” and also later removed posts like “FTX has enough to cover all client holdings” which will very probably wind up in court because the internet never forgets.

Customers of FTX withdrew $6B between Sunday and Monday, a significantly greater rate than typical. Withdrawals from FTX were immediately throttled, and on Tuesday, SBF and CZ stated that Binance had acquired FTX. Thousands of users were tweeting and making memes about the incident at the same time. It was bizarre to witness.

What happens right after Binance pulls out and what is found later on?

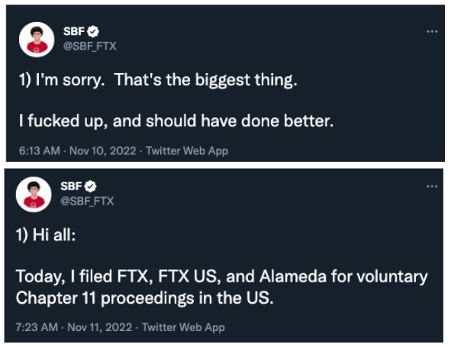

On Wednesday, Binance pulled out of the agreement, and SBF informed investors that he required $8 billion to compensate customers (clearly, FTX had commingled user deposits with the hedge fund).

And the scheme was very much not a “mislabelling” of funds. Per a Reuters report, SBF implemented a “back door” which foiled auditors:

“In a subsequent examination, FTX legal and finance teams also learned that Bankman-Fried implemented what the two people described as a “backdoor” in FTX’s book-keeping system, which was built using bespoke software.

They said the “backdoor” allowed Bankman-Fried to execute commands that could alter the company’s financial records without alerting other people, including external auditors. This setup meant that the movement of the $10 billion in funds to Alameda did not trigger internal compliance or accounting red flags at FTX, they said.“

SBF posted an apology on Twitter on Thursday. Then, the next day, he announced that FTX, FTX US, and Alameda Research, together with more than 130 affiliated organisations, were declaring bankruptcy.

What assets consist in the bankruptcy? Tricky question…

The bankruptcy filing, have “assets in the range of $10 billion to $50 billion, as well as liabilities in the range of $10 billion to $50 billion,” according to CNBC . However, according to a Financial Times study, FTX has $9 billion in obligations and less than $900 million in cash on hand. Additionally, “$470 million in Robinhood shares owned by a Bankman-Fried vehicle not listed in Friday’s bankruptcy filing” was the highest liquid stake. (If you’re wondering where the missing money is, a large portion was put into venture bets and illiquid tokens.)

In the bankruptcy procedures, it is hoped that smaller investors will be given priority; nonetheless, there has been another ludicrous development: over $600 million in client deposits have disappeared from FTX accounts.

It was first noted as a hack. The general counsel for FTX then promised to look into it. The money was then marked as having been stolen. The crypto community then followed the money’s movements. After then, the general counsel for FTX claimed that the fund transfers were related to the bankruptcy procedures. Currently, it appears that $450 million was stolen, with $200 million “rescued” by a white hat hacker. It’s been an insane week for crypto but the insanity doesn’t look like it will end anytime soon.

Implication for crypto world?

This has been the worst few days in cryptocurrency history, according to a scroll through Crypto Twitter. Worse than every foolish ruse and failure that came before.

Why? There is a widespread crypto sell-off in BTC, ETH, and every other asset, raising concerns for those exposed to FTX who may face even more sell pressure (eg. BlockFi paused customer withdrawals). Then there is the demise of SBF, which had the support of numerous platinum names and was positioned to bring crypto into the mainstream. Instead, he damaged industry trust and burned through billions in consumer deposits. Retailers’ and big institutions’ confidence in cryptocurrencies has been pushed back for five to ten years. Regulators will also tighten their controls.

All to increase his hedge fund’s profit a little and more will be coming in the next few weeks, as the Delaware commission analyses data and decides how to proceed with SBF, so stay tuned!!!!

Great topic Pier!! Thank you for sharing it with us👍🏻

Really interesting, thanks for sharing! I’ll investigate more on this topic 🙂

Great work! Thank you🙌🏻

Funny that I was just thinking about this and you posted this blog. Another reason I’ll keep my distance from crypto for a little bit!

What an inspiration! good job

Very interesting piece, crypto is a very controversial topic!

Crypto! Very cool piece, i’m sure it was very cool to research. Thanks for sharing your findings!

Really interesting! Thanks for the insight

Vouv!! Thanks for these information, all of them are amazing. You should post more, you may help me to get rich :))

Very interesting insights. I hope to read more about it in the future!

For sure!!