CRYPTO GUIDE

The first cryptocurrency to come into existence was Bitcoin, which was launched in 2017 by pseudonymous developer Satoshi Nakamoto. Peer-to-Peer Digital and virtual existence of any form of currency is called as crypto currency.

HOW DOES CRYPTO WORK?

A lot of us have stumbled upon crypto many times in the last decade, trying to figure out how it works. Now we know that crypto uses a decentralised system which frees it from the hierarchal structure of power for recording transactions and issuing new units through a process called as mining. All the math enthusiasts benefit here since new coins are generated by solving complex mathematical problems. You must have come across words like Bitcoin, Litecoin, Ethereum, Dodge coin, NFTs, Tether and PolkaDots etc.

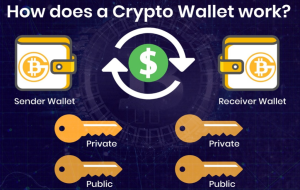

These are all substitutes to online payment which uses encryption algorithms; and in order to use cryptocurrency you must have a wallet which is able to store your keys and access your coins. Wallets consist of public key and private key (online (web), mobile, desktop, hardware, and paper wallets.) for signing to your cryptocurrency transactions.

The bitcoin network relies on a block-chain which is a digital ledger or collection of accounts which facilitates recording of transactions which is set in the stone and cannot be changed over time. Confirmed transactions are collected in the block chain and the block of the bitcoin always consists of a magic number, block size, block header & transaction counter.

Yes, I know this is getting very nerdy, but we need to be able to wrap our heads around these terms.

Each block is limited to 1MB and must contain data (value 0xD9B4BEF9) which can be verified by the network to be validated and adjoined to the block chain. Block header is made up of 6 components adding to an 80-byte field namely:

VERSION

1.0 (crypto currency) for storing data 2.0(smart contract) self-executing programs, like Ethereum 3.0 (DAPPS) creation of decentralized structure. 4.0 (blockchain for industry) economical for everyone to use.

HASH & MERKLEROOT

Computation of large input of data for production of output using brute force algorithm to avoid similarity. Using mathematical formulas for checking the authenticity of data, whether it is hacked or corrupted.

TIMESTAMPS, BITS AND NONCE

Criterion to check the legitimacy of time of any block; and to find target difficulty using NONCE in cryptography is a number used to safeguard private correspondences by preventing attacks.

These records of blockchains are owned by the currency holders and owning digital currency is very volatile. They are intangible assets and block chain technology is still emerging into the financial world.

Your capital is entirely speculative and is quite risky; since there is a chance of hacking or losing your digital wallet meaning losing your entire crypto investment; OOPS!

How to buy cryptocurrency

VIA EXCHANGE

-Log into a cryptocurrency exchange website

-Create your account and substantiate your identity

-Following the instructions on screen you click on buy bitcoin or other assets like Ethereum, Litecoin XRP etc.

-For taking control of your digital wallet, you can always convert from an exchange to a self-custody wallet

VIA BITCOIN.COM WEBSITE

This will require you to add your debit/credit card/apple pay. And for your purchases you’ll need to link an address for receiving your purchased digital asset.This is what your url/address will look like:

bc1qxy2kgdygjrsqtzq2n0yrf2493p83kkfjhx0wlh

-Visit the bitcoin.com website

-Select and pay in your desired currency

-Click the ‘buy’ button and enter your valid wallet address

-Complete the purchase after confirming the payment

VIA BITCOIN.COM WALLET

Since the bitcoin.com wallet is non-custodial you’re always in control. This can be done by opening your app in phone; taping on ‘BUY’ button for purchasing any given digital asset of your choice

-Choose the wallet of your choice to deposit, each digital asset is linked to a separate wallet.

-You can organize your funds by creating individual accounts such as ‘Bitcoin Expenditure’ or ‘Bitcoin Savings’.

-First purchases are always verified while the future purchases are just a tap away. This can be completed within seconds of purchase.

VIA PEER-TO-PEER TRADING PLATFORMS

This can be done by choosing either escrow or a location for sellers and buyers to post their buy and sell orders. This method comes with a price, it is never easy to find a good market rate because of its nature of nonliquidity.

-Choosing a payment type like PayPal, amount and the location of seller, reputation etc. followed by initiating your trade which locks the amount in Escrow account.

-Successful completion of payment which could also be in cash confirming your purchase, which automatically confirms your receipt pinging the digital asset to convert into your wallet.

-Confirming from peer-to-peer platform incurs a fee following their business model.

Disclaimer: Buy only as much as you can feel comfortable losing. I know I don’t like to lose but if you don’t then this investment is not for you.

Non-fungible tokens (NFTs) are coins which you can earn by completing tasks while playing the most played games like Axie infinity (Pokémon NFT), Decentraland (Buying and selling virtual lands), PirateXPirate (PXP tokens in a Pirate Metaverse), Sandbox (Investing in future and Metaverse gaming), STEPN (Winning rewards for your steps) and you can either earn NFTs which can be transferred into your digital wallet, which can be sold for currencies for real-world payments.

Let’s dive into earning while playing your favorite games. As a child, you always dream of getting rich while doing something you really love. Gaming industry makes billions of dollars because of the blockchain technology today and ‘play-to-earn’ games have hiked in the last 5 years.

Non-fungible tokens (NFTs) are coins which you can earn by completing tasks while playing the most played games like Axie infinity (Pokémon NFT), Decentraland (Buying and selling virtual lands), PirateXPirate (PXP tokens in a Pirate Metaverse), Sandbox (Investing in future and Metaverse gaming), STEPN (Winning rewards for your steps) and you can either earn NFTs which can be transferred into your digital wallet; which can be sold for currencies for real-world payments.

Planning to travel today? Expedia’s Vice President of global product believes in adopting to payment technologies, which lets you purchase hotel reservations by indicating bitcoin as their payment option. CheapAir’s fandom dates to 2013 despite the serious financial difficulties of 2022, they accept dozens of crypto payments till date including, Cash, Ethereum, Dodgecoin, Litecoin etc.

You can also book a virgin galactic flight experience. German branch of Burger King has been accepting Bitcoin online payments since 2019; followed by Starbucks and subway using the Bakkt crypto company and lightning network subsequently.

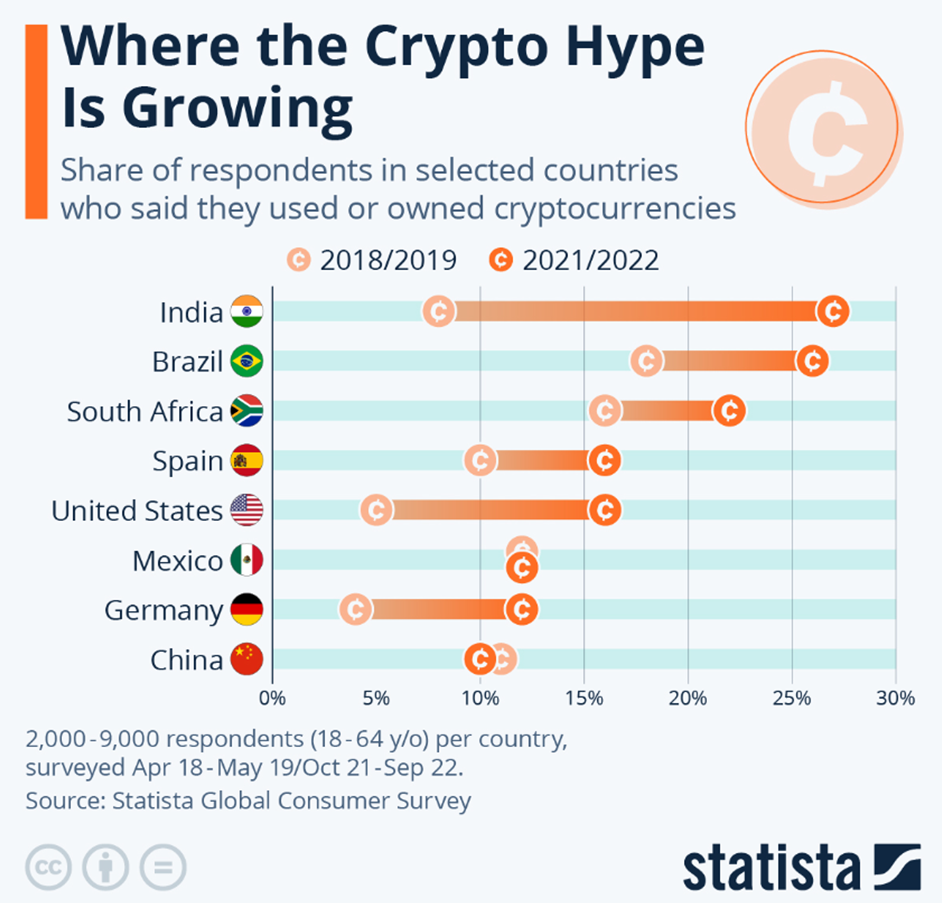

BitPay cryptocurrency processor can be used to buy fashion products from Gucci, Jomashop, Tag Heuer, Farfetch, Balenciaga etc. It is safe to say that crypto has become a world of its own. It has now become a medium of exchange and has the potential to gain even more popularity in the upcoming years.

We can observe that crypto has now started to gain legal tender by some countries like El Salvador, Slovenia, Germany, Canada, Malta, Singapore, Portugal, Switzerland, Estonia, The Netherlands which shows the value of regulations in crypto landscape. However, a few questions of taxation policies, rules and regulations, volatility in nature, long-term investment, expandability, hacking and phishing still exists.

THREE THINGS TO KNOW ABOUT CRYPTO

- Roller coaster ride: There are two ways to the crypto street, you can either become filthy rich overnight or lose everything in a jolt and there is no going back from there. In the last decade crypto has crashed 8 times and the pace setters have gone through these fluctuating losses.

- Crypto is taxable: Yes, your earnings on crypto are taxable to income tax or capital gains tax (CGT) depending upon your sold commodity. Income tax-goods and services and trade-CGT. First $12,300 of any financial year for CGT is tax free. Meeting the threshold of trading is achieved, Net profits will be subjected to income tax at 20%, 40% and 45%.

- Extortionate energy consumption in crypto: IT USES A LOT OF ENERGY and when we say a lot, we mean it! To verify transactions, Bitcoin needs computers to solve more complex problems. Total global usage for assets is accounted at 120 and 240 billion kilowatt-hours/year; which exceeds the total yearly usage of electricity usage of countries like Australia, Norway and Argentina.

This leads us to the real question of whether there is a future to cryptocurrency or not? And can it replace cash in the future?

The reason why barter system was taken over by currency was its dependability of store of value. Although, crypto is in high circulation it will always be unstable and volatile; subjected to a risk of cyber-attacks and in case of national emergencies. It will be a questionable medium of exchange, economists and bank regulator says. It is difficult to predict where the cryptocurrency market is headed in the long term due to the industry being in its infancy and a highly erratic market.

The system is currently prone to cybercrime due to its relatively new, evolving and decentralised technology. Institutions are not hostile towards the idea of cryptocurrency, however, a long-term approach to establish firm laws and regulatory framework is needed to appeal to investors and to initiate a global adoption of the technology. Crypto can never escape paradoxes and analysts estimate that the global cryptocurrency market will more than triple by 2030 hitting a valuation of nearly $5 billion!

Right now people are very uncertain about cryptocurrency, sometimes up and down, many people have benefited from it and many have also faced losses. of course, this is the future, but it is also in its early stages. when retailers giants like Amazon and eBay start accepting this, people’s confidence will be restored. we should give it more time now.

Lots of information in a single click, very informative, Excellent.

This seems quite an interesting take on Cryptocurrency.

Even though crypto is not at it’s finest nowadays but soon it’ll be a game changer in how we make payments.

An excellent quick read but worth so much 👍🏻

Brilliant piece

Very informative! 👍🏻

Crypto is an interesting topic to discuss it!! Thx Umam for sharing this information

It was interesting to know so much about it, Thanks for sharing the information!!

Interesting read

A very good and in-depth view on the transactional benefit and methodology.

Very informative and well written.

Very informative. It’s true the more information you get on crypto currency the more you want to invest into.

I really liked it

It was quite thorough and well written 😌

Crypto world has been evolving and market has improved so much…

You’ve done a really good job here! For someone like me who’s not very well informed about Crypto was able to learn so much! This is surely a brilliant piece 🙂

What an interesting read!

Very informative and to the point.

Loved the examples you had used

Good job

Wow great content

Learned a lot!

Thank you Anthony!

Pretty interesting and informative!

Very nice! A curious subject. Love the memes.

Indeed, thank you Lexie!!

Very detailed and informative.

Thank you Lavin!

Informative and interesting read.

Great content, full of information.

Very detailed and informative

Very informative and to the point.

Very informative. Keep up the good work Umam!

Very interesting and informative

Thank you Sohail

A very concise introduction to cryptocurrency without getting too much into technical details. Excellent read!

Thank you!!

Informative! Everything is perfectly explained which makes it even more interesting👍

Thank you so much!!

Crypto is explained so well. My knowledge is enhanced through this blog. Excellent!

Glad I could help, thank you!

Very well done, keep it up. 👍

Thanks a ton!

This is certainly the best crypto 101 I have come across. Wish I had known this sooner.

Thank you Vedant!

I totally agree with your point on how crypto currency is decentralised and has a risk of cyber attacks.

Overall the blog was very informative and also I agree with all your views on crypto currency and crypto market. Great work!

Thank you for your indepth reply!

Interesting. Very well explained!!

Thank you Ayaan!

Never knew so much information on cryptocurrency. Very well articulated!

Really appreciate it, thanks!!

Thanks for sharing. Very informative.

Thanks a lot!!

Very informative

Very informative! Always been a bit sus about Cryptocurrency since they’re not backed by central banks. But I guess that’s why they are decentralised!

Very informative, thanks for posting

Nice, really informative and easy to get through this reading. Thanks for sharing.

This is an informative and interesting read. Thank you for penning it down so a novice like me can learn about cryptocurrency too.

Love the content very informative and interesting.

Lovely to read ☺️ thank you for sharing Umam!!

Interesting!!👏🏻

interesting article!

Quite informative read – highly recommended!

This is very informative!! Got to know so much about cryptocurrency from your blog. 🙂

This is genuinely SO insightful!